Sustainability Consulting: Empowering Businesses Toward a Greener Future

A deep dive into sustainability consulting and how it drives long-term value, resilience and positive impact for modern businesses.

As the effects of climate change intensify and environmental concerns take center stage, businesses around the globe are being urged to respond. Stakeholders including consumers, investors and governments now expect organizations to act responsibly and reduce their environmental footprint. In this evolving landscape, sustainability consulting has become an essential partner, helping companies transition toward more sustainable and eco-friendly practices.

What Is Sustainability Consulting?

Sustainability consulting involves advising organizations on strategies and practices that improve their environmental, social, governance (ESG) and economic performance. These consultants help businesses reduce their carbon footprint, enhance resource efficiency, strengthen governance structures, ensure regulatory compliance and integrate sustainability into their core operations and organizational culture. Sustainability consultants work with clients across industries—manufacturing, technology, energy, retail and more—to develop and implement sustainable business practices that are both ethical and economically viable.

What Guides Sustainability Consulting?

Sustainability consulting is built on a strong foundation of globally recognized frameworks and principles. These trusted guidelines empower companies to plan, measure and continuously improve their sustainability efforts with clarity and confidence. Here are some of the key ones:

01.

ESG - Environmental, Social, and Governance

What it is: ESG is a framework used to assess how a business impacts and manages risks related to environmental, social, and governance factors.

Environmental (E): How the company affects the planet – carbon emissions, energy use, water management, waste handling, etc.

Social (S): How the company treats people – employee rights, diversity, health and safety, community engagement.

Governance (G): How the company is run – leadership ethics, transparency, board diversity, and compliance.

Why it matters:

ESG gives businesses and investors a clear way to measure and report sustainability performance. It brings accountability and helps companies align with stakeholder expectations.

02.

The Triple Bottom Line (People, Planet, Profit)

What it is: Coined by John Elkington, this principle encourages businesses to focus not just on profits, but also on social and environmental well-being.

People: Fair labor practices, employee well-being and community development

Planet: Reducing environmental impact through sustainable operations

Profit: Long-term economic success without exploiting resources or people

Why it matters:

This concept expands the definition of success from short-term financial gains to long-term impact and responsibility – a mindset that drives sustainability consulting.

03.

UN Sustainable Development Goals (SDGs)

What it is: The 17 SDGs are a global blueprint adopted by the United Nations to promote prosperity while protecting the planet. These goals include ending poverty, ensuring clean energy, promoting gender equality and taking climate action.

Why it matters:

Sustainability consultants often align business strategies with specific SDGs. For example, a company working on renewable energy can align with SDG 7: Affordable and Clean Energy. This global alignment adds meaning, credibility, and clarity to sustainability goals.

04.

Regulatory and Industry Standards

What it is:

These are formal frameworks and legal requirements that help businesses measure, report, and improve their sustainability performance. In India, companies are expected to align with both global best practices and local regulatory mandates.

India-specific frameworks include:

BRSR (Business Responsibility and Sustainability Reporting):

Mandated by SEBI for the top 1,000 listed companies, it requires detailed disclosures on ESG practices. It reflects India’s move toward structured, transparent sustainability reporting.CSR Mandate under Companies Act, 2013:

Indian companies meeting certain financial thresholds must spend 2% of their profits on Corporate Social Responsibility (CSR). This ensures businesses contribute to social and environmental development.Energy Conservation Act & BEE (Bureau of Energy Efficiency):

Promotes energy efficiency across Indian industries and commercial buildings.EPR (Extended Producer Responsibility):

Applicable to sectors like plastics and e-waste, EPR mandates companies to manage post-consumer waste responsibly.

Common global standards include:

GRI (Global Reporting Initiative) – For sustainability disclosures, TCFD (Task Force on Climate-related Financial Disclosures) – For climate risk reporting, ISO 14001 – For environmental management systems, CDP (Carbon Disclosure Project) – For tracking and reporting carbon emissions

Why it matters:

These frameworks ensure companies not only act ethically and responsibly but also comply with evolving national and global expectations. For sustainability consultants, understanding these standards is crucial to guiding clients toward credible, compliant, and impactful sustainability strategies.

Impact of Sustainability on Business

1. Cost Savings & Operational Efficiency

Sustainability often leads to resource optimization, helping businesses cut costs in energy, water, raw materials and waste disposal.

- Lower utility and operational costs through energy-efficient systems

- Reduced waste and packaging costs via circular practices

- Leaner supply chains through sustainable sourcing

2. Risk Mitigation & Compliance

Sustainability helps identify and mitigate risks—whether environmental, reputational or regulatory.

- Stay compliant with evolving regulations (e.g., SEBI BRSR in India, EU CSRD, US SEC climate disclosures)

- Reduced risk of penalties or disruptions due to environmental non-compliance

- Enhanced ability to navigate climate-related risks

3. Investor and Market Access

Sustainable companies attract more attention from ESG-focused investors, funds and financial institutions.

- Better access to green financing and lower cost of capital

- Higher ESG ratings, making companies more attractive to institutional investors

- Inclusion in sustainability indices and rankings

4. Enhanced Brand Reputation

Today’s consumers and stakeholders value purpose-driven brands. Sustainability efforts boost customer loyalty, brand differentiation and market positioning.

- Improved public perception and media coverage

- Increased brand trust among environmentally conscious consumers

- Higher customer retention and advocacy

5. Innovation & Competitive Advantage

Sustainability drives product and process innovation that can open up new revenue streams and markets.

- Development of eco-friendly products and services

- Adoption of green technologies and digital tools

- Entry into sustainability-driven markets or government programs

6. Long-Term Business Resilience

Sustainability builds organizations that are better equipped to adapt to future disruptions, market shifts and climate impacts.

- Future-proofing operations against resource scarcity and climate volatility

- Building agile, transparent supply chains for greater resilience and staying ahead of industry trends

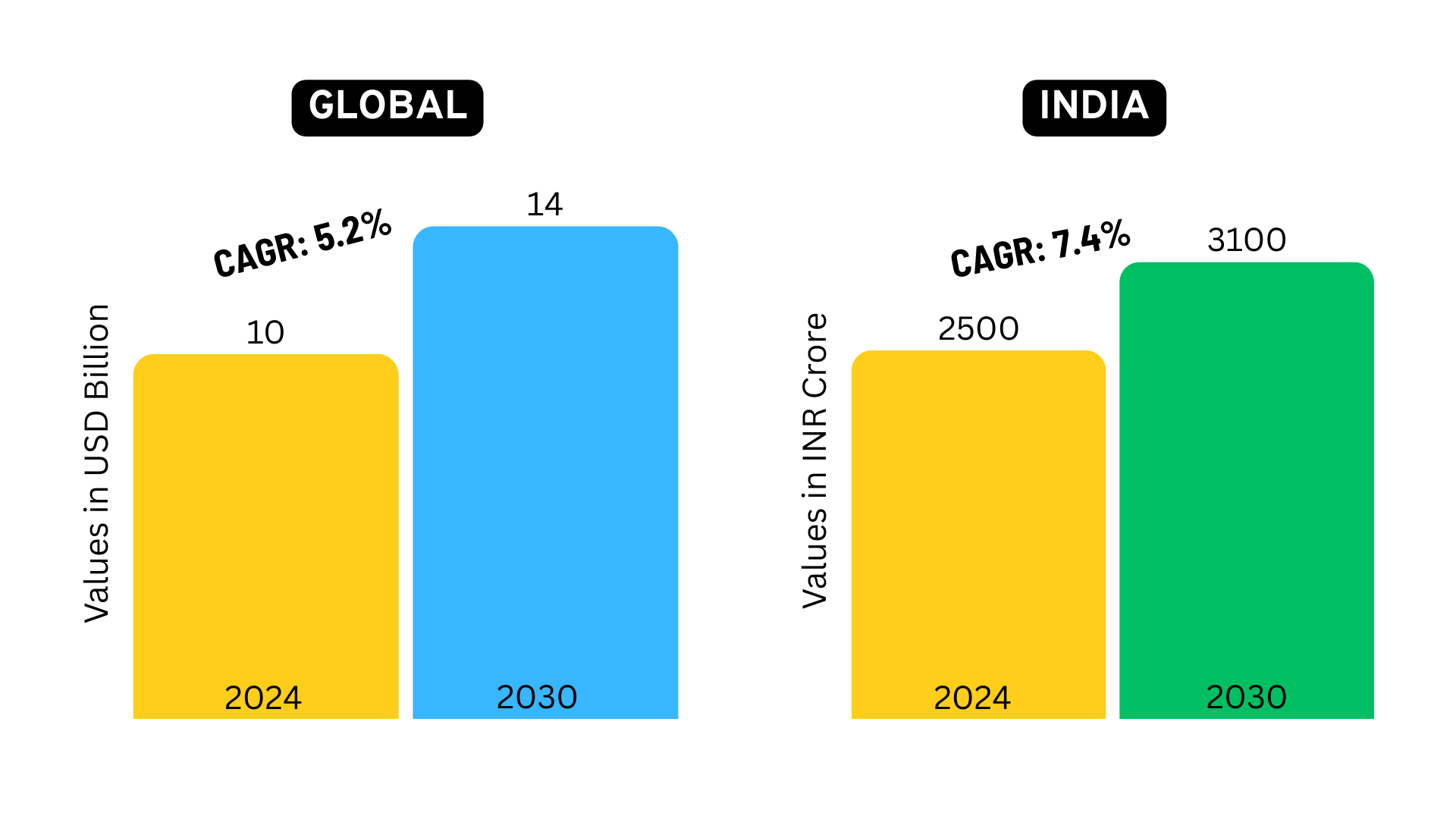

Sustainability Consulting Market - Global and India

India’s sustainability consulting sector is still emerging but gaining rapid traction. The shift is fueled by climate risks, evolving regulatory frameworks (e.g., BRSR reporting) and the government’s commitment to net-zero emissions.

Indian Sustainability & ESG Consulting Market Size: Estimated around INR 2,500 crore as of 2024

Growth Rate: Projected CAGR of 7–8% over the next 5–7 years—higher than global average due to India’s development needs

Services Offered Under Sustainability Consulting in India

1. Decarbonization Strategy

Carbon footprint assessment: Measuring Scope 1, 2 and 3 emissions using GHG Protocol and other recognized methodologies.

Net Zero roadmap: Defining emission reduction targets and timelines aligned with global climate goals.

Carbon offset strategy: Selecting credible offset projects to compensate for unavoidable emissions.

2. Energy Transition

Renewable energy adoption: Supporting shift to solar, wind, biomass or hybrid energy solutions.

Energy audits: Identifying energy inefficiencies and opportunities for optimization.

Grid decarbonization strategy: Transitioning energy systems from fossil fuels to clean sources.

Battery and storage solutions: Assessing energy storage options for reliability and efficiency.

3. Circular Economy

Waste minimization: Reducing material waste through efficient production and supply chain strategies.

Product life cycle extension: Promoting repair, refurbishing and reuse to maximize product utility.

Material innovation: Replacing high impact inputs with sustainable materials.

Sustainable packaging: Designing eco-friendly packaging that reduces plastic use and enhances recyclability.

4. Social Impact Consulting

Community engagement programs: Creating local partnerships that drive social development and goodwill.

Inclusive business models: Promoting diversity, equity and access across value chains.

Social impact measurement: Tracking and communicating the effectiveness of social initiatives.

Human rights due diligence: Ensuring fair labor and ethical practices in operations and sourcing.

5. Regulatory Compliance & ESG Reporting

Environmental compliance: Helping companies meet national and international environmental regulations.

BRSR & ESG reporting: Preparing disclosures aligned with SEBI’s BRSR, GRI, CDP, SASB and more.

Sustainability audits: Identifying gaps in ESG performance and compliance readiness.

Third-party assurance support: Facilitating external validation of ESG data and disclosures.

6. ESG & Sustainable Investment Advisory

ESG strategy & framework development: Building long-term ESG visions, goals and governance frameworks tailored to business needs.

ESG integration: Embedding ESG factors into investment decisions, enterprise risk, reporting and performance monitoring.

Green finance advisory: Structuring green bonds, sustainability-linked loans and accessing ESG funding mechanisms.

7. Climate Risk & Resilience Assessment

Physical risk assessment: Analyzing exposure to climate-related events like floods, droughts or extreme heat.

Transition risk analysis: Evaluating risks from regulatory changes, technology shifts and market pressures.

Scenario planning & TCFD alignment: Preparing businesses through future-focused scenario modeling.

8. Sustainable Supply Chain Management

Supplier assessments and audits: Evaluating vendors based on ESG standards and performance.

ESG risk scoring: Assigning sustainability ratings to suppliers for better decision-making.

Green procurement: Designing procurement policies that favor eco-friendly and ethical vendors.

Vendor engagement: Providing training and tools to help suppliers align with sustainability goals.

9. Sustainability Communications & Branding

ESG storytelling: Showcasing sustainability efforts through websites, reports and campaigns.

Sustainability marketing: Strengthening brand equity through purpose-driven marketing strategies.

Annual sustainability reports: Designing visually engaging, data-backed ESG disclosures.

Internal awareness: Driving organizational buy-in through workshops, campaigns and training.

Top Sustainability Consulting Firms in India

With the growing trend and adoption of sustainability consulting, India is now home to a large number of firms offering these services. Explore the top sustainability and ESG consulting firms in India — including full-service consulting firms that offer sustainability as part of a broader portfolio, as well as boutique firms that specialize exclusively in sustainability and ESG. In addition to traditional consulting players, technology consulting firms are also entering the space, offering tech-enabled solutions such as ESG reporting platforms, AI-based climate risk modeling, sustainable supply chain analytics etc.

Large full service firm

Large full service firm

Large specialised firm

Large full service firm

Large full service firm

Large full service firm

Large full service firm

Large full service firm

Large full service firm

Large tech firm

Large tech firm

Large tech firm

Large full service firm

Large full service firm

Large full service firm

Large tech firm

Large tech firm

Large tech firm

Large tech firm

Large specialised firm

Mid Size full service firm

Small full service firm

Small Specialised firm

Small Specialised firm

Small Specialised firm

Small Specialised firm

Small Specialised firm